In the End, the Strategic Bitcoin Reserve Was the Friends We Made Along the Way

Plus: Was Trump planning to crash the economy? The OCC does something good. And the IRS Rule is one step closer to defeat.

I started Brogan Law to provide top quality legal services to individuals and entities with questions related to cryptocurrency. Cryptocurrency law is still new, and our clients recognize the value of a nimble and energetic law firm that shares their startup mentality. To help my clients maintain a strong strategic posture, this newsletter discusses topics in law that are relevant to the cryptocurrency industry. While this letter touches on legal issues, nothing here is legal advice. For any inquiries email aaron@broganlaw.xyz.

Last week, Mr. Trump and Mr. Sacks spent all of Sunday talking up their plans to develop a digital asset reserve, putatively containing XRP, SOL, and ADA. After some private musing, they decided to add Bitcoin and ETH to the list of chosen assets. On this news, crypto asset prices briefly surged last week, though without regaining their previous highs.

Well, after a wild week of sharp swings in asset prices, the White House finally landed on a reserve policy on Thursday, and the market doesn’t like it!

On Thursday, the White House issued an executive order titled “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.” Basically, the effect of the order is to direct the Treasury and Department of Commerce to collect all the bitcoin they have and, uh, not sell it. They are also authorized to “develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies impose no incremental costs on American taxpayers.”

At the same time, the order directs the government to create a “U.S. Digital Asset Stockpile” containing, presumably, XRP, SOL, ADA and ETH (and any other digital assets they stumble into), which were “forfeited in criminal or civil asset forfeiture proceedings.” With respect to this pile of assets, however, “The government will not acquire additional assets for the U.S. Digital Asset Stockpile beyond those obtained through forfeiture proceedings[]” and the Treasury is permitted to consider sales.

Despite being an obvious reversal of the policy proclamations of last weekend, Mr. Sacks heralded the reserve, such as it was, as a victory on X. And maybe it was. In the period after Mr. Trump made his initial announcement, significant concern emerged as to the government’s ability to buy cryptocurrency assets without congressional approval. That approval was doubtful. The idea of using seized assets has been floating around for a while, so it may just have been the best that they could do.

This policy issue aside, the White House had some messaging problems with last week's plan. Primary among these, everyone hated it. The public was mad because they perceived it as obvious graft orchestrated to drive up asset prices of key Trump supporters. The Bitcoin people were mad because the initial statement privileged other tokens before it. Even David Sacks was mad because the public accused him of pumping his own bags, which he reportedly sold before taking this public role.

Reports emerged midweek that Ripple may have been a driving force in the decision to include certain alt assets in the initial reserve plan. Decrypt reported that Ripple executives “pitched President Trump to include SOL in the crypto reserve plan announced on Sunday to give the reserve more legitimacy among the crypto community, according to two sources familiar with the matter. The inclusion of SOL also helped Ripple convey that it was advocating for a crypto reserve that included several American tokens.” While unconfirmed, this report did little to quiet the murmurings of inside dealing surrounding the project.

Ultimately, it seems this was all too much smoke for the Trump administration. The White House was forced to backtrack and ultimately implement this, slightly milquetoast, policy.

Certain KOLs heralded this as a win. And it probably was—not the in the way that the crypto-community had hoped during the campaign (buying their bags)—but in the limited sense that it will allow the Trump administration to move on to other policy issues and place this one squarely in the “done” pile. That is genuinely worth something!

The markets were unpersuaded however, and Bitcoin has since crashed to below $77,000 at time of writing. This is correlated with other selling action that we will discuss a little bit later, but the half-measure Bitcoin reserve clearly wasn’t providing the boost that some close to the administration hoped.

Pompliano Says Trump is Crashing Asset Prices to Lower Interest Rates

So after the last few weeks of asset prices crashing, regaining ground, and then crashing again, they seem to be settling at “crashed.” At time of writing, the SP500 closed down ~9% from its recent high. As I wrote last week, this is the combined effect of bearish signals and Mr. Trump’s stochastic tariff policy spooking investors.

People tend to own assets, so when their prices crash, that is usually bad for most people. Sure there are some bears with puts out who make a lot of money, but that's a tiny minority of the population. Generally the rule is, asset prices up: good, asset prices down: bad.

So you’d think that would mean this crash, which wiped trillions of dollars of value out of the economy today would also be bad, right?

Well think again my friends. This is a different kind of crash. A special crash. This is just the crash the economy needed. At least, according to a certain subset of right leaning-crypto X, that is.

I first saw this take last night from Anthony Pompliano, who, presumably seeing where the futures market was heading, got out ahead of the story.

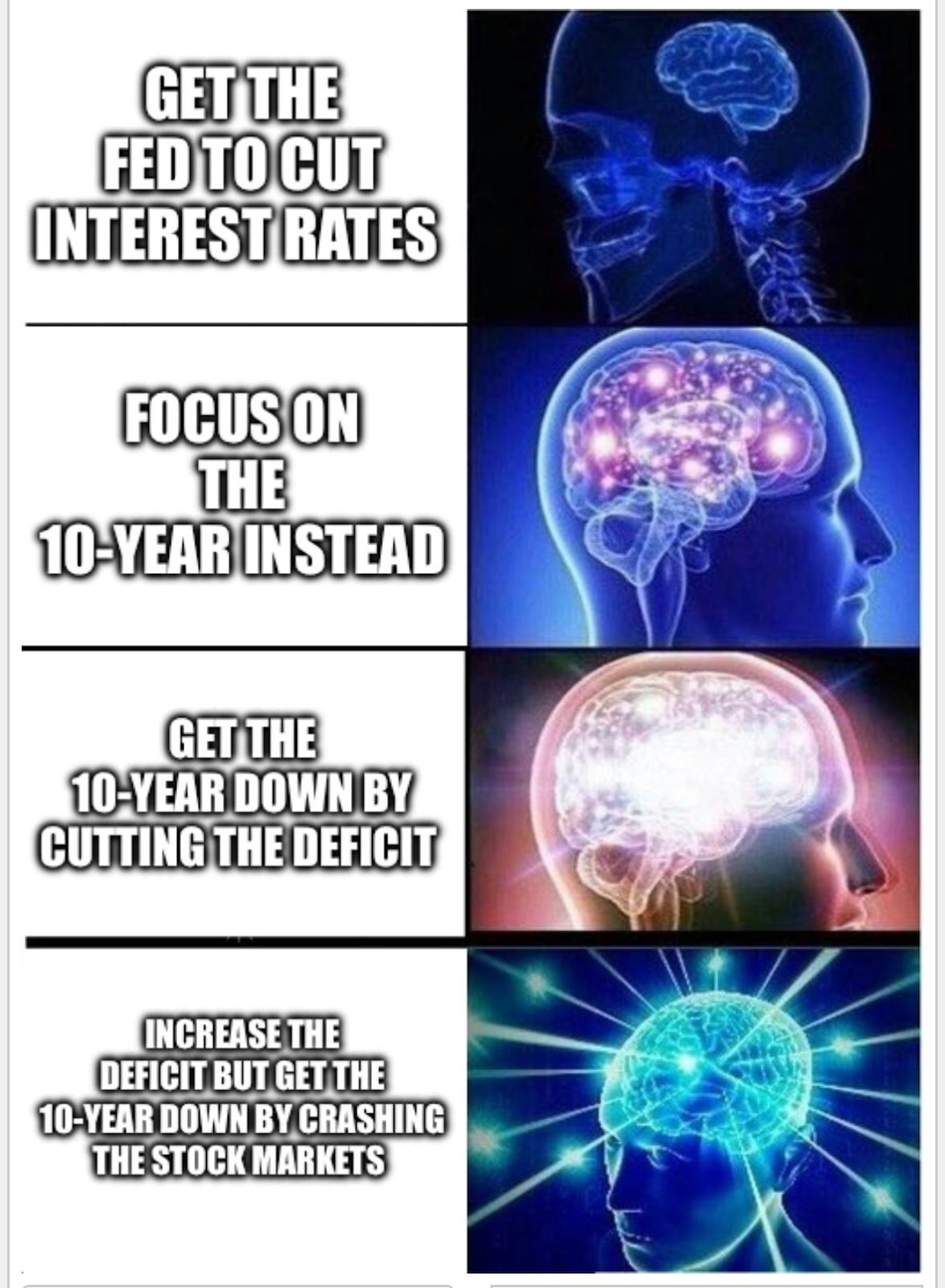

It’s not actually a nonsensical tariff policy spooking investors, it's a plan, man. We’re going to crash asset prices so that everyone is poor. That way, there can’t be inflation anymore. Matt Yglesias aptly parodied the thinking this afternoon.

After noting the first instance, a number of other right leaning crypto-influencers began to pick up the same thread and make similar arguments.

If you search X, you will find many posts with similar verbiage!

My first impression of this line of argumentation is that it is absolutely braindead posturing from mindless shills—which it may well be. The degree of coordination in the messaging here between Mr. Pompliano, Martini Guy, and Ash Crypto is suggestive of the possibility that, behind the scenes, someone is enforcing message discipline across these separate accounts.

This kind of coordinate messaging has been alleged before at a few different times. In one scandal, the Justice Department alleged that certain right wing influencers including Tim Pool were paid by Russian adjuncts to disseminate anti-Ukraine propaganda and “amplifying U.S. domestic divisions.”

More recently, Pirate Wires reported that Kalshi was directing influencers like Antonio Brown to smear Polymarket in the wake of the FBI raid of Shayne Coplan’s New York home.

In other words, these things do happen. There is no direct evidence of coordination, but the similarity in messaging raises questions (earnest, non-defamatory questions). If it is true, it may precede a pivot in Trump policy messaging that we could see play out over the coming days.

“No guys totally don’t worry, we’re crashing the economy on purpose, we definitely wanted this to happen, for real though.”

Make note if this starts happening.

It is easy to poke fun at this news cycle, but here's the rub. While this is one of the craziest lines of messaging I’ve seen, it is actually (sort of) how Fed policy has historically worked! Between 1979 and 1981, after years of “stagflation” Fed Chair Paul Volcker committed to ending inflation at any cost, pushing the fed funds rate to nearly 20%.

In so doing, Mr. Volcker did cause recession, called a “Volcker Shock” but is also credited with successfully ending the period of inflation by “cooling” the economy. In justification, he argued: “Everybody likes to get rid of inflation but when one comes up to actions that might actually do something about inflation, implicitly or explicitly, one says: ‘Well, inflation isn’t that bad compared to the alternatives.’”

Mr. Volcker continued, “we see the risks of the alternative of a sour economy and an outright recession this year. So, maybe there’s a little tendency to shrink back on what we want to do on the inflation side. I don’t want to shrink back very far...” This resolve may have meaningfully ended a difficult economic period, though causality is difficult to establish in macroeconomics.

This time around, Jerome Powell has widely been credited with a “soft landing” that prevented recession while nonetheless slowing inflation, yet that inflation has not slowed enough to return to zero-interest rates. Mr. Trump likes zero-interest rates because they help people get rich. Other stakeholders advocate for lower interest rates because much of the US’ debt will roll over this year. If it does so at a relatively high rate, it could dramatically increaese the cost to taxpayers of servicing the debt.

You can’t just lower the rates, though, or inflation will spike as a mechanical result of printing new money to pay debts without restricting money production elsewhere in the economy. If the economy crashes, on the other hand, that pain elsewhere in the economy might sufficiently offset the inflation-producing effect of lower rates and hold inflation down.

Does this make any sense as a policy? I actually do not know. It is extremely difficult to handicap the cost of recession as compared to the cost of increased long-term interest payments. One way or the other, the government is probably on the path to fiscal austerity. ”TANSTAAFL” economists sometimes like to say. “There ain’t no such thing as a free lunch.”

Did the Trump administration crash the economy intentionally, though? Much easier question. No, obviously not. That would be insane.

OCC Interpretive Letter 1183

A couple weeks ago, we covered the reversal of SEC SAB 121. Basically, the SEC under Gary Gensler created conditions that made it impossible for regulated banks to custody cryptocurrency, and this administration reversed that.

Well, this week the Office of the Comptroller of the Currency (OCC) followed this up with more crypto-friendly banking guidance in Interpretive Letter 1183 (IL1183). The effect of IL1183 is to rescind previous unfriendly OCC guidance previously distributed in November 2021’s, Interpretive Letter 1179 (IL1179).

IL 1179, now branded with a bold red “RESCINDED” mark, was essentially a proviso to earlier guidance permitting banks to conduct certain cryptocurrency related activities including (i) custodying cryptocurrency, (ii) holding dollar deposits as reserve-backed stablecoins, and (iii) operating validator notes.

While these activities were permitted, the standard required by IL1179 was quite high:

“[these activities are] legally permissible for a bank to engage in, provided the bank can demonstrate, to the satisfaction of its supervisory office, that it has controls in place to conduct the activity in a safe and sound manner.”

This may not sound like much, but in the world of prudential regulation it is close to prohibition.

Banks were required to seek permission first before doing any of these activities for the purpose of enhancing “prudential supervision by ensuring that banks demonstrate, before engaging in the activities, that they can conduct them in a safe and sound manner and in compliance with applicable law.”

As with many government mandates, IL1179 referenced a laudable goal—safe custody of assets—but had a completely different effect. Looking at the dates of some of the underlying memoranda, previous interpretive guidance 1170, 1172, and 1174 were all issued in the waning days of the Trump administration, and IL 1179 came in the early days of Biden. In some sense, then, they have been passing this hot potato back and forth for some time.

From the guidance alone, it is impossible to say how many banks would have custodied cryptocurrency, backed deposits with stablecoins and operated nodes, but safe to say that in the Biden years few, if any, did.

Even if this kind of guidance provided the veneer of acceptability, the procedural requirements it imposed are chilling. With it now rescinded by IL1183, it is likely that more banks will be acceptive of certain cryptocurrency activities in the future.

Some have associated this policy shift with Trump’s commandment that he will “end Chokepoint 2.0”, but such a connection is speculative at best. De-banking didn’t have to do with custodying cryptocurrency itself, but the denial of traditional banking services to individuals and entities related to crypto. This is more pernicious, and perhaps harder to root out, because the policy seemed to exist in the interstitial spaces between the minds of regulators and bankers.

Still, this change will improve access to services in crypto, and that is worth celebrating.

The Senate Votes Yes On CRA

A few months back, we had Bill Hughes on to talk about the IRS DeFi reporting rule, and the various paths to defeating it. The clearest path, we learned then, was through the Congressional Review Act. To recap, for any regulation signed in the last 60 legislative days of a previous administration, if both houses of congress vote to rescind the rule, and the president then signs it, then the rule is struck down and the regulatory authority is prohibited from promulgating anything “similar”

Well, last week the Senate voted and passed the resolution 70-27. The House still has to pass the resolution, but the victory in the Senate is a major step towards reversing the rulemaking. These rules may, in turn, be replaced with new language passed through the budget reconciliation process.

This years tax changes have not received much press yet, perhaps as a consequence of the familiar flood of headlines out of the White House, but it is sure to be hugely consequential to the taxation of cryptocurrency for years to come, so we’ll see if we can cover it in the coming months.

Until then.

Brogan Law is a registered law firm in New York. Its address and contact information can be found at https://broganlaw.xyz/

Brogan Law provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers.