Bank Deposits Are Worth More Than Stablecoins

Custodia Bank has developed a new stablecoin model. This is an opportunity to think bigger.

I started Brogan Law to provide top-quality legal services to individuals and entities with questions related to cryptocurrency. Cryptocurrency law is still new, and our clients recognize the value of a nimble and energetic law firm that shares their startup mentality. To help my clients maintain a strong strategic posture, this newsletter discusses topics in law that are relevant to the cryptocurrency industry. While this letter touches on legal issues, nothing here is legal advice. For any inquiries email aaron@broganlaw.xyz.

This week, Custodia Bank CEO Caitlin Long xeeted out a new technology that caught my eye.

Now, on its face, this thread does not tell you much about what is going on behind the scenes or why this would be interesting, but with a little knowledge of the banking system it starts to look very compelling.

For one, effectuating cross-border U.S. dollar payments on-chain is a highly valuable service. There have been reports on and off for the last year of certain companies doing this internally, most notably Chamath Palihapitiya’s1 December comment that SpaceX uses stables to transfer Starklink incomes back to the United States without relying on cross-border wires.

But this is the first I’ve heard of a bank doing this directly, and that is an interesting wrinkle because, until now, cross border transfers to the United States have approximately all taken place through the legacy SWIFT system, and SWIFT sucks.

SWIFT is a fifty year old messaging protocol and international banking consortium that allows banks to send cross-border payments securely. While the messaging itself is instantaneous, the system is slow because it is highly intermediated and each leg is performed in sequence. As modest delays stack the system slows. It also relys on banks that operate during banking hours, extending delays and leaving it inconsistently available.

Now, I shouldn't besmirch SWIFT too much. The problem with these payments is often the banks, not the communications system itself. When SpaceX does internal transfers using blockchain, that saves a lot of time because it doesn’t require a bank at all. This disintermediates the process. But if your bank substitutes stablecoin transfers on the back end for SWIFT, but mades no other changes, it might not make as much, or any, difference. Still an interesting development.

To me, a second advantage of this system is far more interesting, though. Custodia uses a stablecoin called an Avit that it purports acts as a demand deposit. Regulatory environment permitting, this could reorder the stablecoin landscape.

Money is just worth more in a bank than it is in stablecoins.

The Difference Between Stablecoins and Bank Deposits

Of course, as I’ve written here before, a stablecoin is a demand deposit. If you read Custodia’s now-abandoned patent application for Avits, the structures will be closely familiar. A user transmits fiat into an omnibus trust account which mints an Avit token in exchange, the user can then move that around the Ethereum blockchain, until they wish to redeem it with the bank, after which the dollar is moved out of the trust account and the cryptocurrency token is burned.

Now, there is some advantage to doing this seamlessly within a single bank. It means that instead of intermediated off-ramping, switching between crypto and fiat rails can be accomplished instantly on an internal ledger. That is better, and you can bet that if major players like BofA and JPMorgan Chase enter the space, that is what they’ll do. But that is not all.

Consider your classic stablecoin model. Circle takes in a bunch of money, and issues a bunch of stablecoins called USDC. Those tokens whiz around the economy, enervating systems, but the money that went into Circle mostly just sits there. Well, Circle buys U.S. Treasuries with it, which helps fund the United States government and marginally reduces its cost of capital. But this probably rounds to nothing right now.

Now consider the legacy system, the “demand deposit.” In this world, you go earn your 7.25 an hour at the Hardee’s and take it to the bank, and they swallow it up and issue you a deposit. That deposit is an instrument that allows you to come in at any time and receive cash back from the bank.

But the bank doesn’t just buy treasuries with that money and wait. Instead, generally, banks engage in something called fractional reserve banking. They lend with it! They can’t lend it all straight out the door, they have regulatory reserve requirements, which might be, say, 10%. But practically they actually end up lending more than you put in.

Most people imagine that for every ten dollars that come in, a bank will lend out nine and keep one as reserve. But it doesn’t work that way. Banks keep the $10 and lend out $90.

Where does the $90 come from, you ask? They create it out of nothing. This is the money creating function of banking. And this is what distinguishes bank deposits from stablecoins.

Hard Money History

Once, we had the gold standard. U.S. Currency was backed by a pile of gold deposits sitting in a vault in a nondescript corner of Kentucky. Then, in 1971, Richard Nixon dropped the gold standard and let the dollar float.

Now, in the contemporary economy, most money is certificated by notations in ledgers at banks. So when banks want to make a loan, they don’t have to go acquire a dollar. A person at a bank (or maybe a piece of code) presses a button and one dollar appears in the borrower’s account, while another dollar appears in the bank's claims receivable column. Just like that, a new dollar hits the economy.

The stablecoin model doesn’t work like this, it certificates a dollar on the blockchain but it doesn’t create anything new. But what Custodia is doing, and what other banks might do depending on how GENIUS shakes out, is taking the first steps towards merging the models.

Sounds Risky

Reasonable minds can differ as to whether this is good or not. For one thing, the practice of borrowing short and lending long, as this approach to banking is sometimes known, is fundamentally risky and unstable.

We’ve covered the basic dynamics of a bank run here before, but as soon as people start to question the availability of deposits at a bank, they are incentivised to withdraw as quickly as possible. Everyone has this incentive at once, and if everyone tries to withdraw money that is lent out in loans, the bank won’t have the money and will collapse. This isn’t a symptom of poor management or bad luck, it is the unavoidable logical structure of banking.

Basically, though, this problem is solved.

For stablecoins it has been solved by maintaining 100% collateral backing. If everyone can always get their money back, there is no incentive to run. But for bank deposits, it is solved by deposit insurance, and that works incredibly well. If I’ve said it once I’ve said it a hundred times, the FDIC is the greatest thing since sliced bread. Since it was formed in 1933 it has both turned a profit for U.S. taxpayers and prevented any retail bank run for nearly a hundred years. A lender of last resort is sufficient to stabilize banking systems, so fully collateralized reserves are unnecessary.

To be fair, the risk of explosion is not the only critique of the fractional reserve banking model. Generally, some market observers believe that money has gotten too easy, and that this lack of discipline has undercut the real economy, leading to financialization and wealth concentration among the very few.

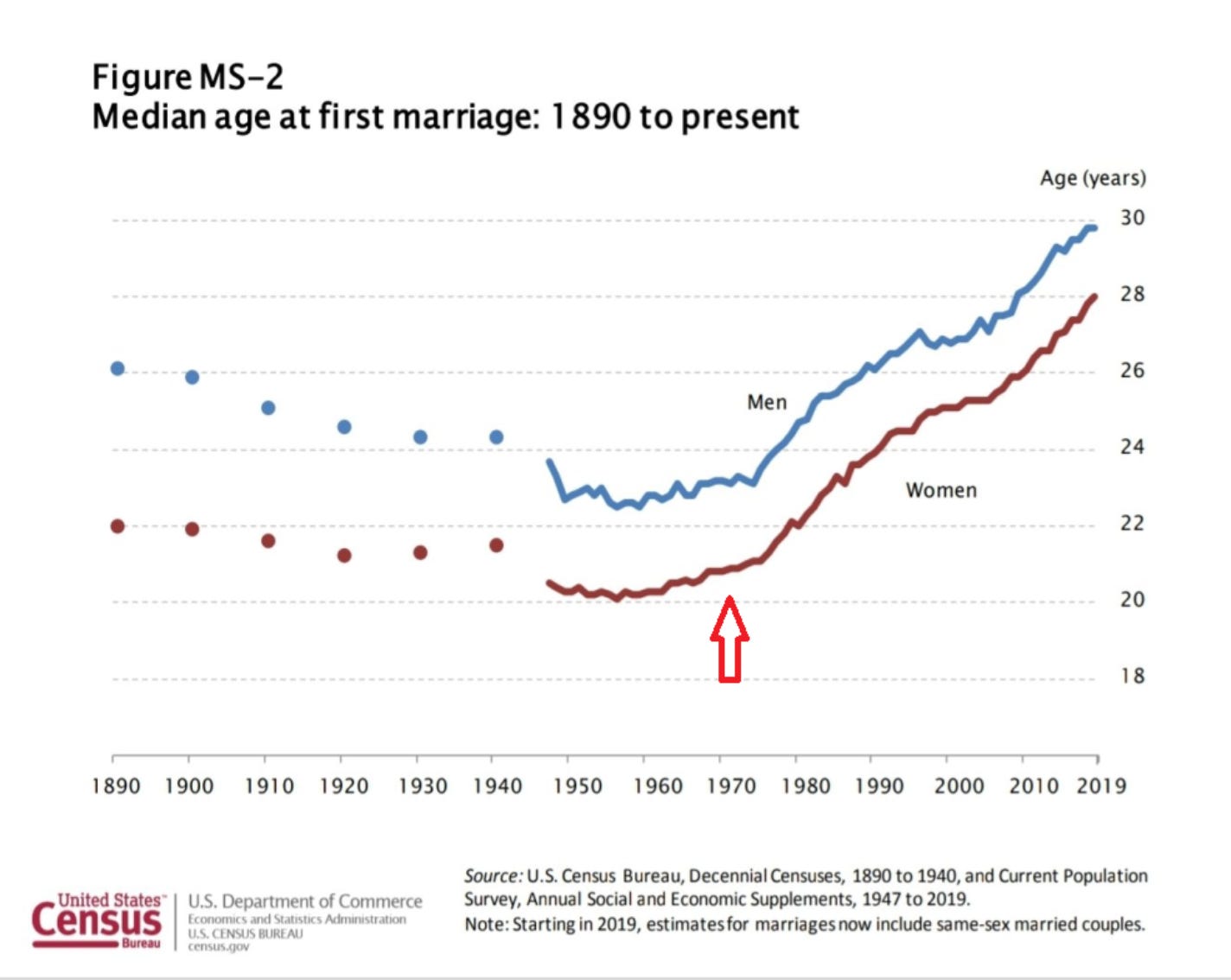

There may be some truth to this. There is a frankly bizarre series of charts showing negative trends starting in roughly 1971. You can find them collected in the website wtfhappenedin1971.com.

It’s impossible to say whether the change in monetary policy in 1971 caused the wide range of shifts in American life that followed, or was symptomatic of other ongoing changes. After all, Nixon didn’t abandon the gold standard for no reason. But it is certainly disquieting to see, and has led some — including Satoshi Nakamoto — to prefer a future of narrow banking and hard money.

And to What End?

And at first glance, you can see their point. I mean, what does all this money creation do anyway? We all know that if you took every dollar and made it ten dollars, that wouldn’t reorient society at all. Things would just quickly cost ten times as much and return to status quo.

During the transition period between a narrow banking paradigm and a more aggressive money creation regime there will be a temporary boom as latent demand works itself out. But after a while, unless the real output of the economy has increased, nothing much will have changed.

Here is the rub. There is reason to think that the easy money model does increase the real output of the economy. For one, to the extent there is latent demand, it is realized, creating a one-time persistent step change in the level of economic activity. More things are built, those things do things, and then more things result. This is good for the economy, albeit only on the margin.

But even ignoring that, the 90/10 society has a much higher debt level than the 9/10 society. The initial ten dollars of bank deposits is the same, but one system creates 90% debt and the other 900%. Ten times as much!

And again, reasonable minds could differ. High levels of private debt can correlate risks, leading to generational collapse like the 2008 Global Financial Crisis. But on balance, a high debt society is probably closer to maximizing its economic potential than a low debt one. That is because each dollar of debt is stimulating some real growth in society, and that growth is exponential. The entire private equity industry is premised on the theory that a company with a lot of debt is worth more than a company without enough debt. The fractional reserve banking model does the same thing on a society-wide scale.

If stablecoins models of banking end up dominating traditional deposit banking, and stablecoins remain 100% collateralized, it will lead to a collapse of the private money supply. Some people think that is a good thing, but in the short term it would risk recession, and even in the long run it would probably lower the ceiling on the American economy. But it doesn’t have to be that way. Custodia’s model is an early demonstration that deposit banking might be accomplished through on-chain assets, and future participants should consider building on it.

Plus, whoever figures out a fractional reserve stablecoin model is just going to make way more money and dominate its competitors.

Of course, if legislation mandates full collateral, that may be impossible.

GENIUS is Dying

Last week, we took a look at Senator Ruben Gallego’s sudden discomfort with the GENIUS Act and speculated at some causes.

Well, this week, things did not look bright for the prospect of stablecoin legislation in the United States. After Gallego’s statement on Saturday, Democrats generally signalled discomfort with the bill, but Republicans pushed forward and moved for cloture on Wednesday.2 That vote failed 48-49, with all the Democrats voting no, along with Republicans Rand Paul and Josh Hawley (and, technically, Majority Leader John Thune, although he only did this in order to be on the prevailing side of the vote, allowing him to move to reconsider it later).

In the immediate aftermath of the failure, a lot of people ran it through the spin cycle, suggesting that this was “only a procedural vote” and that the Republicans could reintroduce it. All true. On the Democrat side, some noted that they hadn’t actually seen the current draft bill yet, making it difficult to vote for cloture. Also true.

Ya but, it is not exactly a show of strength here. Cloture is a procedural vote, sure, but it is a necessary predicate to actually passing this legislation. If you’re coming up 12 votes short, you are really not cooking with gas.

I think the issue here is that key stakeholders felt that the Democrats would get on board for bipartisan crypto legislation because PACs like Fairshake made it rain in 2024 and bandz famously do a-make them dance. And if it turns out that they are not on board then GENIUS and Market Structure are both dead in the water.

There are a few theories about what is actually happening here. The first is that the Democrats are just now realizing the optical challenges of handing legislative victories to Donald Trump, particularly in an industry where he stands to profit directly. Ya, sure, that makes sense. Some lobbyists I spoke to suggested that Elizabeth Warren is using the uncertainty to flex her muscle and try to kill the industry. Also on brand.

But does that really explain it? Midway through the week, another explanation began to percolate through the X-waves.

Now, Ryan Selkis and Amanda Fisher are odd bedfellows. But there sure is a lot of smoke! I mentioned last week that the Coinbase, Ripple and a16z backed PAC Protect Progress spent over $10 million in Ruben Gallego’s Senate race last year. It does seem just a touch rich to think that he would publicly attack the bill against their wishes.

And there was a quite noticeable silence from Coinbase on GENIUS in the lead up to the cloture vote, followed by a milquetoast post-mortem xeet from Brian Armstrong that was hardly an endorsement.

Coinbase has a lot of power these days, and if they wanted GENIUS passed, I kind of think they’d say so! But hey, I’m just a lawyer in New York writing a newsletter, and maybe they’re playing six dimensional chess on some higher plane. We’ll all just have to see what happens.

Until next week.

Brogan Law is a registered law firm in New York. Its address and contact information can be found at https://broganlaw.xyz/

Brogan Law provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers.

So take it with a grain of salt, I guess.

The effect of cloture is to end debate. This vote is a prelude to a Senate vote on the bill itself, and requires 60 votes to succeed.

Very interesting Aaron. Thank you.