Someone Doesn't Like the GENIUS Act, but Who?

Plus: granular policy arguments about decentralization and liberalization of the securities laws.

I started Brogan Law to provide top-quality legal services to individuals and entities with questions related to cryptocurrency. Cryptocurrency law is still new, and our clients recognize the value of a nimble and energetic law firm that shares their startup mentality. To help my clients maintain a strong strategic posture, this newsletter discusses topics in law that are relevant to the cryptocurrency industry. While this letter touches on legal issues, nothing here is legal advice. For any inquiries email aaron@broganlaw.xyz.

Ripple Wants to Buy Circle

Ah another week gone and another batch of crypto news with it. I’m covering a few interesting policy papers this week, but there are a few choice happenings that deserve coverage first.

On Wednesday, news broke that Ripple had offered to buy Circle for $4-5 billion. Initial reports were that the offer had already been rejected, and some speculated that the basic sequence had been:

(i) Ripple makes a lowball offer for Circle

(ii) Circle says, “oh ho ho, kindly go away”

(iii) Ripple immediately leaks the offer to the press for clout

However, as the week progressed, uncorroborated reports suggested that Ripple had increased its offer significantly and that talks may be progressing. Again, the truth of this is unconfirmed, but you can see why Circle might be interested.

A month ago when I wrote about the Circle S-1, I speculated that the planned IPO might not actually happen. Since then the stock market has mostly recovered (somehow the S&P 500 closed down less than 1% in the month of April), and the economy ascended from tariff hell to mere tariff purgatory.

That said, there are black clouds gathering around the economy, Mr. Trump is suggesting that children might not need quite so many toys, and Republicans in Congress seem to already be cooking a recession in.

For Circle’s principals, who have probably been thinking about the juicy potential of an IPO for years, you can see why the relative certainty of a fat Ripple offer might start to look good compared to jumping into turbulent public markets.

But why would Ripple want it?

Well, we know why Ripple actually wants it, because they have only recently emerged from under the shadow of a half decade of litigation and want to use their war chest to make a dent in the world of cryptocurrency. But when you buy Circle, is that really what you get?

Mostly you actually get a box filled with around $60 billion of assets and $60 billion of liabilities. Your liabilities are all callable on a short-term basis, so you really have to keep all of the assets in short term, highly-liquid debt. This means that the value of that box is incredibly sensitive to interest rates. If Mr. Trump gets his way and cuts rates to zero, that $60B of assets (mostly Treasury debt) turns into a non-yielding liability, your spread evaporates, and the box has very little or negative value. But if Japan dumps Treasuries and yields spike it could turn out to be a pretty lucrative box.

That is a kindof hard bet to make with a lot of leverage though, right? It’s not like Ripple has $10 billion of dry powder laying around for this deal, they’d be selling some kind of Circle debt, and that seems pretty risky. Sure, on one hand, your exposure to interest rates is hedged a bit: if rates go down you refinance, but if they go up you get a windfall.1 But on the other hand, there are other risks too.

The most salient is the still percolating GENIUS Act stablecoin bill. As financial institutions have signaled that they are likely to piggyback on any legislation to launch their own stablecoin products, it is entirely plausible that legacy institutions like Circle are outcompeted. For instance, one could imagine Goldman Sachs or Bank of America negotiating exclusive distribution deals with cryptocurrency exchanges like Coinbase and OKX in the future which limited demand for USDC. Kind of hard to imagine a Ripple-Circle with $10 billion in debt surviving that scenario.

But you do have to risk it for the biscuit!

Then again, maybe Ripple had early word that GENIUS wasn’t going so well, as later in the week Democrat Senator Ruben Gallego very publicly announced that he and his Democratic colleagues no longer supported the current iteration of the bill.

Now, I don’t want to seem cynical, but it seems relatively unlikely that this group of Senators suddenly came to their senses and realized that the mostly benign stablecoin bill they had previously supported lacked protections they refused to name. Something happened to cause them to oppose this bill. Maybe it is the case, as was suggested by Politico, that these Senators grew nervous about the optics of Mr. Trump’s World Liberty Financial firm profiting off the stablecoin regulation, but that does seem like a bit of an abrupt development. After all, the Trump family’s forays into crypto are hardly new.

The other two options are roughly (i) they want something from someone and can use this as leverage or (ii) some influential donor wants to kill the bill or use it for leverage.

Over the past year, much has been made of the cryptocurrency money in politics — most notably through Fairshake, a highly influential PAC supported by the cryptocurrency industry. Fairshake didn’t support any of the candidates who registered their concerns for GENIUS.

It turns out, though, that another cryptocurrency PAC, Protect Progress, is a major supporter of Gallego, running a $3 million ad campaign on his behalf, and spending a total of over $10,000,000 in support of him during the 2024 campaign.

And who are Protect Progress’ top donors? Ripple, Coinbase, and Andreessen Horowitz.

Now, it is impossible to say if one of these three has a reason to attempt to scuttle GENIUS. In the past, Coinbase has attempted to bundle the pending market structure legislation with stablecoins to make it more likely to pass, garnering much criticism, as Veronica Irwin of Unchained reported in March.

Basically, the thinking is that many firms feel conflicted about market structure, which some think will tend to benefit large institutional players at the expense of smaller firms, but stablecoin legislation is broadly popular, so if the large players use their political clout to combine the bills, it will be more likely to pass than market structure would be alone.

Is this what is happening now? It is impossible to say, but I am starting to think I know what prominent cryptocurrency attorney Jake Chervinsky was talking about when he tweeted this on Friday:

So is it possible that the weight of Ruben Gallego’s conscience became too great to bear and he chose to defy the group that bankrolled $10,000,000 of his Senate campaign to speak his mind on stablecoins? Sure. Senate terms are long, and maybe he thinks he’ll have enough time to recover before 2030. Oh and also, I have a bridge in Brooklyn I’d like to sell you.

Two Interesting Papers

One of the most interesting parts of cryptocurrency this year is the flurry of non-profit papers. Back in February, SEC Commissioner Hester Peirce put up the bat signal with There Must be Some Way Out of Here, a 48-question catechism for the industry.

Everyone and their mother responded. We’ve covered some here before. We responded! A client reached out to us a few months back and we wrote up some suggestions. Even as infighting and mistrust have vitiated industry cohesion, these papers have been a constant font of creativity and collectivism.

It’s been fun. I’ve enjoyed reading them.

This week, I want to highlight two that represent divergent strands of thought among cryptocurrency policy minds, and different paths for blockchain technology to take in the coming years: Designing Policy for a Flourishing Blockchain Industry from the Decentralization Research Center (DRC) and Project Open: Proposing the Open Platform for Equity Networks from the Solana Policy Institute (SPI), Zagreus Services LLC, and Lowenstein Sandler LLP.

The DRC paper provides a principled framework for structuring individual policy decisions according to ”longstanding principles advanced by the cypherpunk and open-source communities.” DRC inheres to the so-called “control framework” proposed by Miles Jennings at a16z, but in a highly specific way with a focus on the core values of cryptocurrency.

In so doing, DRC articulates seven principles that it argues should exist within a legal framework, agnostic to whether that framework comes in market structure legislation or SEC rulemaking. For each principle, they include the principle, a rationale, example language that might implement it in regulation or legislation, and a discussion of limitations of the principle or carveouts.

The last part was particularly compelling to me, as their proposal that “principles should be expressed at a high level, while granting implementing agencies the authority to issue detailed guidance and establish rules-based exemptions” is dead on. As unpleasant as it is to give regulators discretion in their application of laws, that is the only way policymaking can ever be effective.

So, the priniciples. DRC argues that exempt blockchain networks should be:

1. Open

2. Autonomous

3. Permissionless

4. Non-Custodial

5. Distributed

6. Credibly Neutral

7. Economically Independent

And, listen, they’re not reinventing the wheel here. These are principles that have been kicking around the community since inception. But the paper distills them wonderfully in an actionable way, and that is laudatory.

The only point that I quibble with is the adherence to a “broadly distributed threshold of 20%”, which was present in FIT21, but seems unnecessarily punitive to me. My rough understanding is that the current structure of market structure does not contain this constraint anymore, but I haven’t seen the draft bill myself so I don’t know for sure.

There is another open question left at the end of the DRC’s paper, “Application of the Principles Above the Base Layer.” DRC concludes that above L1, “different weights should be assigned to the principles depending on context” and leaves the question of what and when those might be for another day.

This second layer question is exactly where SPI & Co. come in. Project Open is a proposed framework to bring securities on-chain, which fundamentally by its structure exists a level above the base layer or L1.

SPI proposes a specific, time-limited, pilot program. Indeed, the pilot is not just limited in time but in scope too, as the paper states that “initial issuers would be limited to a pilot cohort, which number may grow as the project progresses.” The reasons you might propose this are straightforward. The SEC is likely to be trepidatious about reordering all primary issuance of securities to the blockchain, which the incentives of the proposed program could arguably induce, so a limited test-run could help make the thing actually happen instead of dying in the drawing room. Some ideas are too dangerous for the public to take in all at once.

And, essentially, the idea is for the SEC to use its Section 28 exemptive power under the Securities Act of 1933 and Section 36 exemptive power under the Securities Exchange Act of 1934 to make it legal for companies to issue securities on the blockchain, and crucially to make it legal for those securities to trade via smart contract without requiring a registered intermediary like a national exchange or an alternative trading system.

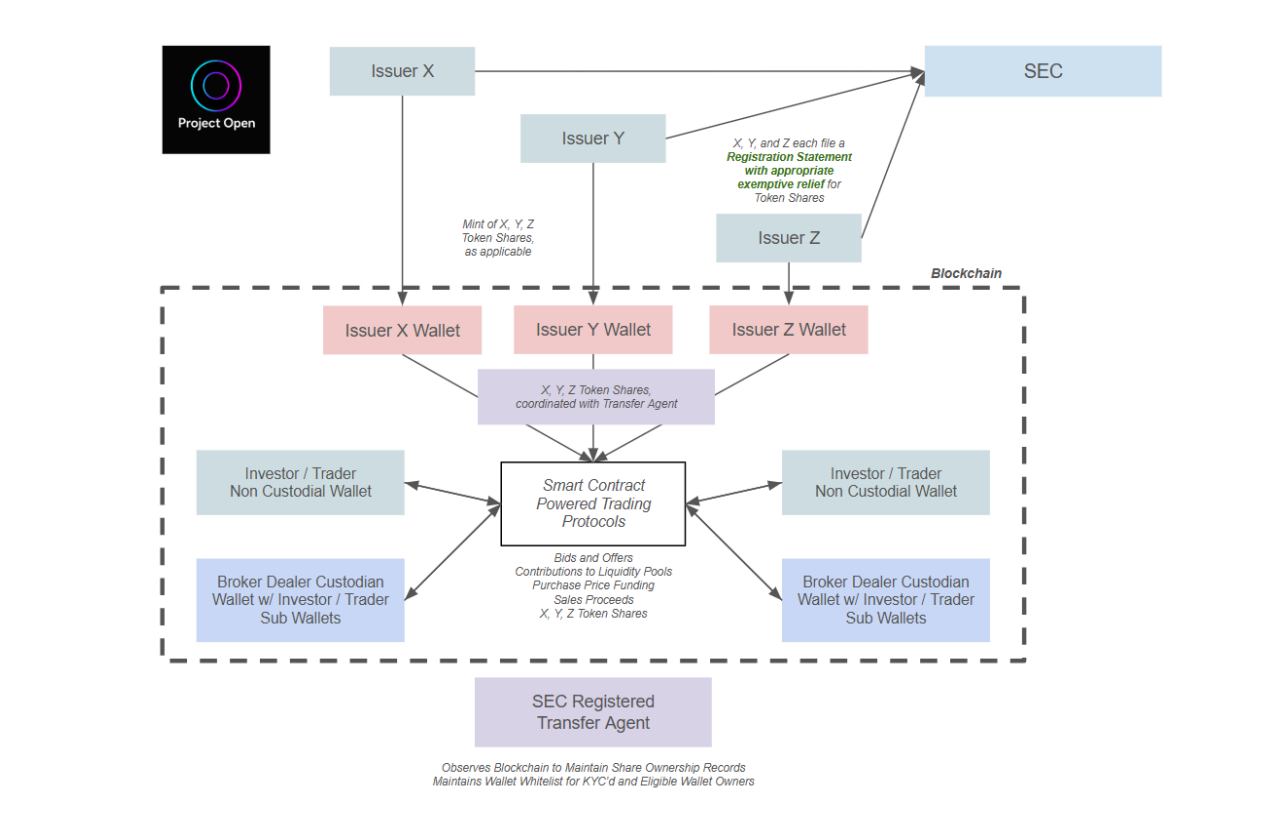

The SPI group proposes some contours to this idea: the issuers will have to include a registration statement or prospectus, much like the S-1 that is already filed before a public offering; there will be a transfer agent, and “issuers will coordinate with their independent Transfer Agent to ensure that the Transfer Agent retains a super administrative authority over the Token Shares in order to give these digital Transfer Agents identical capabilities as traditional transfer agents to address idiosyncratic circumstances,” and; settlement will be instantaneous and wallet-to-wallet without permitting for net settlement or uncleared transactions.2

But basically here is what it comes down to. Right now, you can issue securities with a token component if you want, but it will probably be relatively illiquid and difficult to trade, and it basically retains the features of a normally certificated security. If Project Open were implemented, those security tokens could be traded freely with virtually no risk of regulatory reprisal.

Which is a really good idea! But I do have a few concerns. For one, while the intermediate facilitating transfer would cease to be a regulated party in this conception, a lot of that locus of regulatory control would simply shift to the transfer agent. The extent of this is obvious when you look at the Project Open proposed diagram:

The “SEC Registered Transfer Agent” sits above the whole thing! And in their framework, this transfer agent has the authority to look through the entire stack of transactions, control the white list, and authority to ensure users “have undergone a KYC and educational onboarding process.” The transfer agent is the god king of the ecosystem, acting, as the SEC once accused Coinbase of doing, as the exchange and clearinghouse in one (and perhaps as broker-dealer too, if they are allowed to wrap that function in).

This is a risk! And more importantly it is centralization. While this proposal would live on an L2, and the DRC explicitly left open the sound application of principles there, I somehow doubt that this could meet the standard set by the core principles of cryptocurrency. As I have argued many times, the project of the cryptocurrency industry is the liberalization of the securities laws, and shifting the intermediary from one regulated entity to another won’t achieve that end alone.

I think there is more time to have this debate, and we may speak to some of the principals involved in the future, but that's all for now. Until next week.

Brogan Law is a registered law firm in New York. Its address and contact information can be found at https://broganlaw.xyz/

Brogan Law provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers.

Note I wanted to use an em-dash here, but LLMs have ruined the fun for me. Goodnight you princes of Maine, you kings of New England.

Of course, not all transactions on the blockchain settle instantaneously as there can be forked blocks on certain networks that delay finality, and it is possible for other technical errors to occur.

Great piece!

I cannot imagine mass tokenization of equites and other securities moving forward without a legislative rethink of TEFRA. Am I wrong? Please share your thoughts on the effective ban on bearer instruments inherent in TEFRA.