Brogan Law provides top-quality legal services to individuals and entities with questions related to cryptocurrency. Cryptocurrency law is still new, and our clients recognize the value of a nimble and energetic law firm that shares their startup mentality. To help our clients maintain a strong strategic posture, this newsletter discusses topics in law that are relevant to the cryptocurrency industry. While this letter touches on legal issues, nothing here is legal advice. For any inquiries email info@broganlaw.xyz

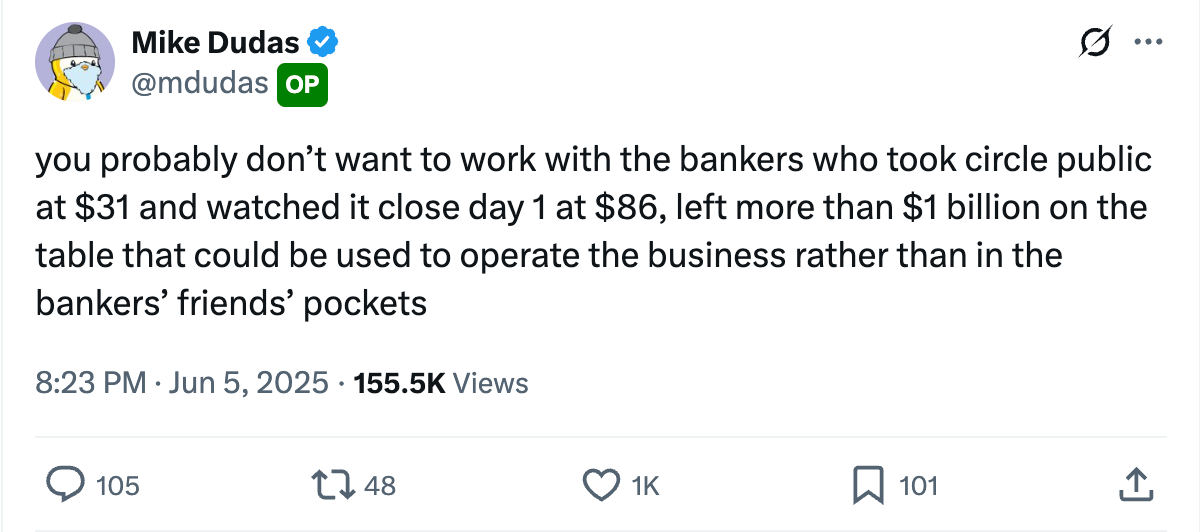

This week, Circle IPO’d. And, despite my kvetching in recent months, all indications are that its ascent to public markets was a success. The IPO was reportedly 25 times oversubscribed, and the stock popped from an offering price of $31 to over $123 on Thursday, prompting some industry insiders to question the fidelity of the bankers involved in the offering.

As recently as last month, I had some doubts about Circle’s business. Stablecoins are the best business model in the world, ok.1 You take a bunch of cash in and mint some tokens at zero marginal cost. You make it sort-of hard for token-holders to redeem them, park all the money in low risk assets, and keep the spoils. And somehow Circle manages to be the second largest company doing this business in the world, but still only post a 9% net profit margin in 2024.

I joke, a little — there are known reasons that Circle has been relatively unprofitable. The stablecoin business is so simple it creates complexity, namely distribution. Hundreds of enterprising men, seeing the dazzling potential of this business, have tried to fire up their own stablecoin entrant, and approximately none have succeeded. Stablecoins have decent regulatory arguments that they cannot pay yield, so tokens can’t compete on upside. Instead, the primary differentiation is risk profile and brand, and since risks are mediated by scale, this probably means that the stablecoin market will end up being distributed by a power law.

Knowing this, Circle sold off half of its income to Coinbase in exchange for a market, and it worked. A high price to pay, but better to be half of an industry leader than all of nothing.

So sure, Circle is not as sick as Tether, who reportedly realized $13 billion in net profit with only 200 employees in 2024, but it still has a solid business model and a large share of a growing segment.

And that’s all fine, but does that really mean that Circle is worth its current $22 billion market cap? There were reports of Ripple bidding $10 billion for the issuer (Ripple denied these), and even that figure made me nervous. Did something change in the last few weeks?

Yes.

The Three Crises

In May, three events occurred near simultaneously that, together, make Circle seem like a much surer bet than I thought even a few months ago.

First, on May 16, the credit rating firm Moody’s downgraded U.S. national debt from Aaa, its highest rating, to Aa1, its second highest. This may seem like a small change, particularly since it is still very highly rated, and the other two agencies, Fitch and S&P made the change long before.

Moody’s evaluation, though, is chilling.

Over more than a decade, US federal debt has risen sharply due to continuous fiscal deficits. During that time, federal spending has increased while tax cuts have reduced government revenues. As deficits and debt have grown, and interest rates have risen, interest payments on government debt have increased markedly.

…

we expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation. We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024.

…

While we recognize the US' significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics.

You don’t have to think about the dynamics here too hard to see the problem. Interest payments on the national debt are causing deficits to increase. That’s a feedback loop. That’s exponential. If this is your base case, either something changes, or the fiscal posture of the government continues to deteriorate until tax receipts fund nothing but interest.

The next event occurred on May 21, when, in the wake of the downgrade, the U.S. had a bad Treasury auction.

So the way the U.S. national debt works, mechanically, is that periodically the Treasury needs some cash, so it holds actions and sells off large lots of bonds to raise it. They sell as much of this as they can through non-competitive bids at a fixed price, but if they can’t raise enough money that way, they have to accept competitive bids. Institutions post bids, and the Treasury accepts the lowest yield possible to clear the sale.

And now, the competitive bids are growing more expensive. From The Hill:

On May 21, a lackluster 20-year U.S. Treasury bond auction delivered what can only be described as a resounding vote of no confidence in Washington’s economic stewardship. The numbers were as stark as they were symbolic: a bid-to-cover ratio of 2.46 and a yield of 5.047 percent — the highest in five years.

A higher yield means investors demanded more return for the same risk. They trust the U.S. less, and we all have to pay.

Finally, the hammer.

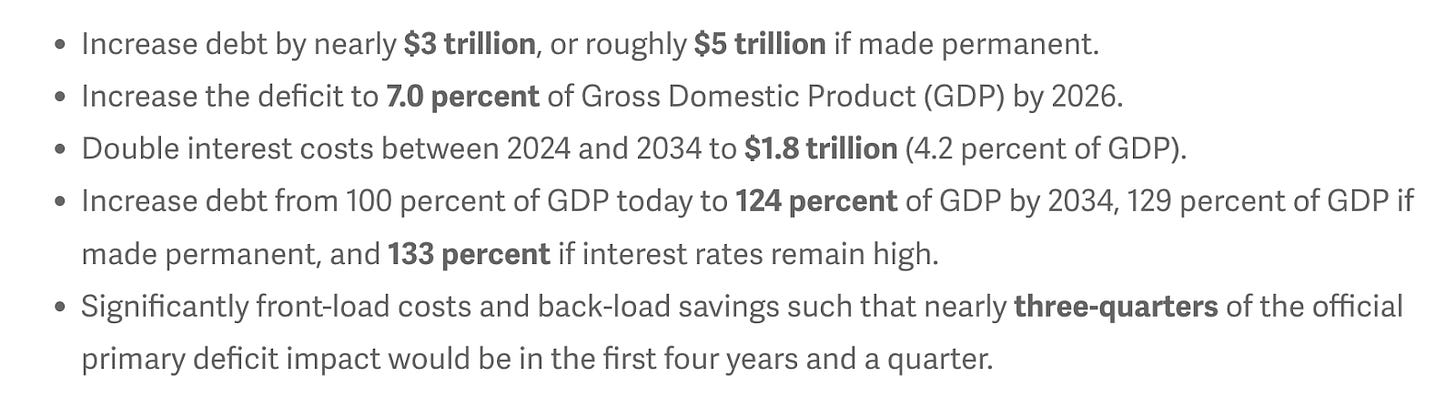

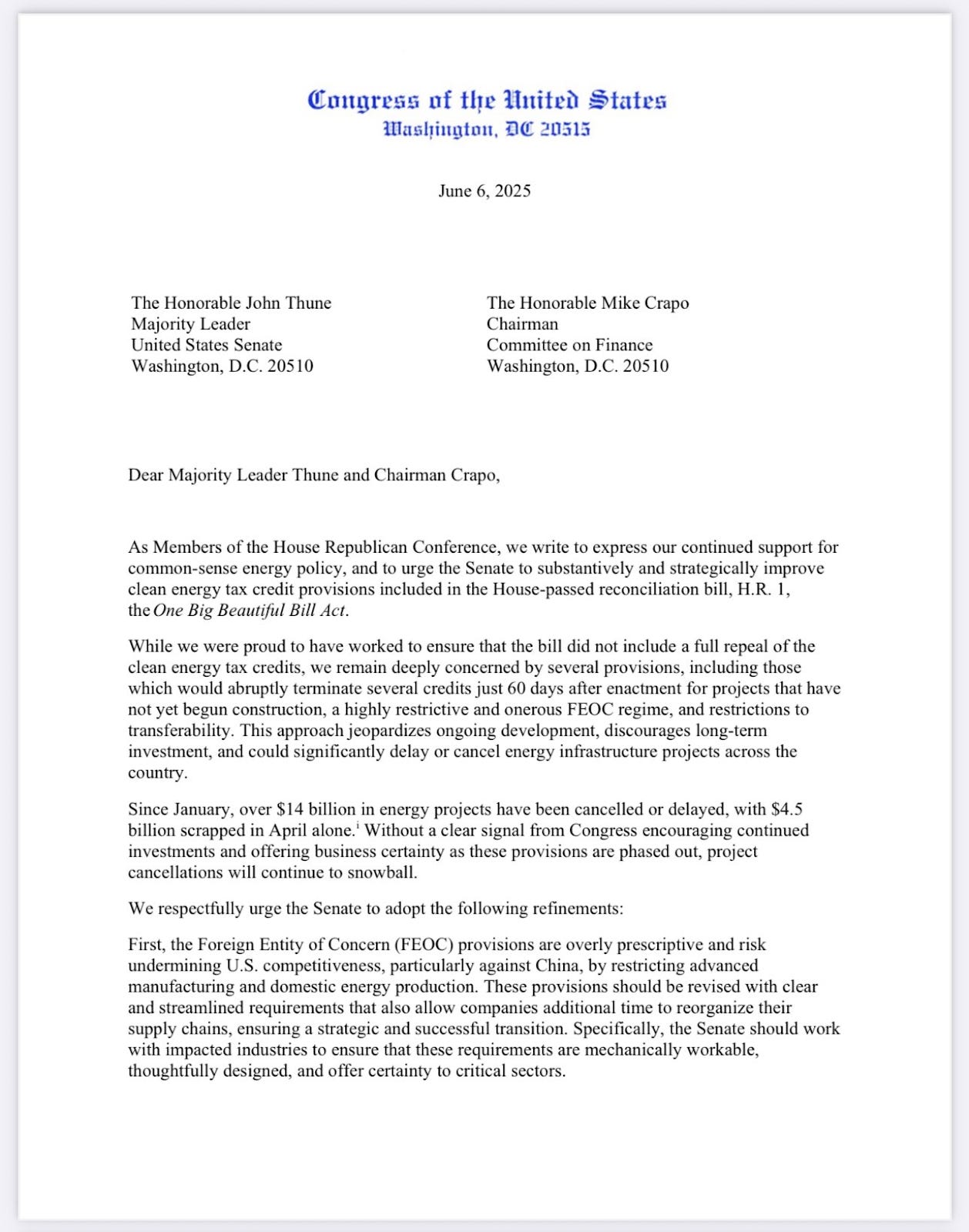

On May 22, Mike Johnson shoved Donald Trump’s One Big Beautiful Bill Act (BBB) down the House's throat in the dead of night (or, actually, something more like the crack of dawn). For all the reasons that Moody’s downgraded the U.S. and the bond market spurned our debt, the spending and tax bill really had to decrease the federal deficit. Instead, the Congressional Budget Office estimates that BBB will increase the national debt by $3 Trillion over the next ten years.

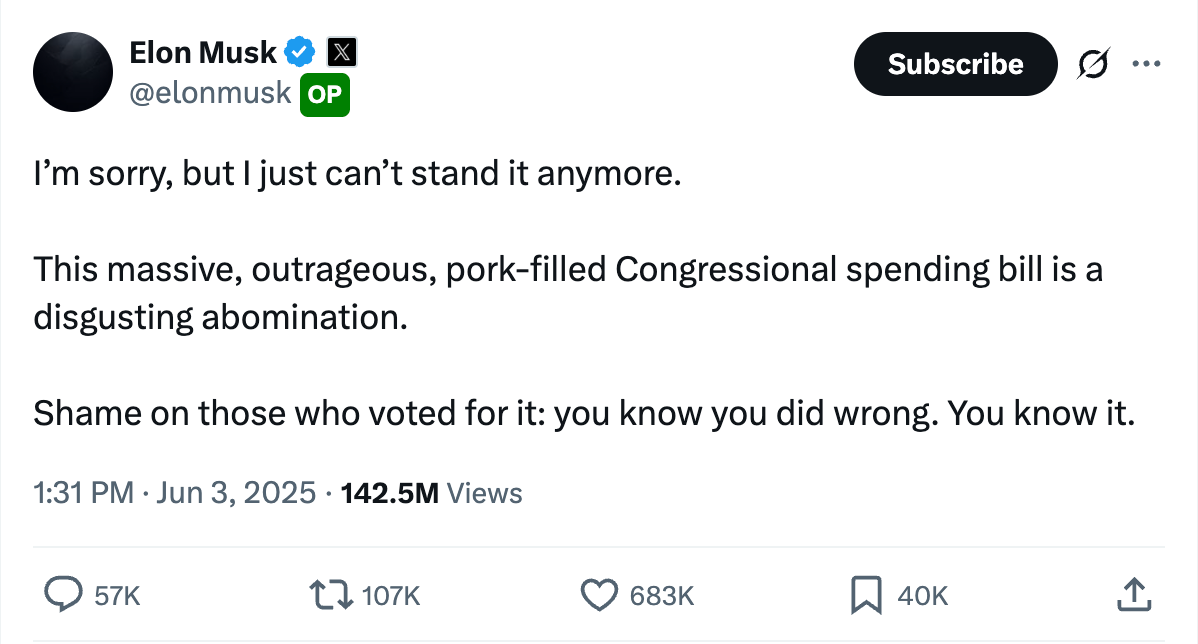

Since then, some fiscal conservatives like Rand Paul and Ron Johnson have protested the bill in the Senate. Heck, Elon Musk blew up his whole life over it!2

But the politics are undeniable. Republicans hold 53 seats in the Senate, and have J.D. Vance to serve as tiebreaker. If these Republicans found 50 votes to confirm Tulsi Gabbard, Robert F. Kennedy Jr. and Pete Hegseth, they are passing BBB.

Musk (or someone who shares his interests) has recognized this firewall and since attempted to stir discontent in the much more vulnerable House of Representatives instead — whipping 13 members who voted for the bill to speak out against it.

And that is great for them, as far as it goes. If this thing ever went back down to the House it might be in genuine trouble. But the Republicans are not stupid, and my read is that it will never get there. Unless something changes unexpectedly in the Senate, when Johnson pushed BBB through on the 22nd, he sealed our fate.

The Debt Trap

This is all bad news for the United States, but it is probably good news for Circle. If you hold a pile of money that you are only allowed to buy Treasury debt with, you are very sensitive to the yields that Treasury debt pays, and the events of May 16-22 suggest that the yields Treasury debt pays are going up and staying up.

Back a couple weeks ago when I talked about the potential for Ripple to buy Tether, I mentioned that it might be risky to take out a bunch of debt against such a business when the President is publicly campaigning to drop rates to zero. After all, in the lower rate environments of the early 2020s, Circle’s incomes were dramatically lower.

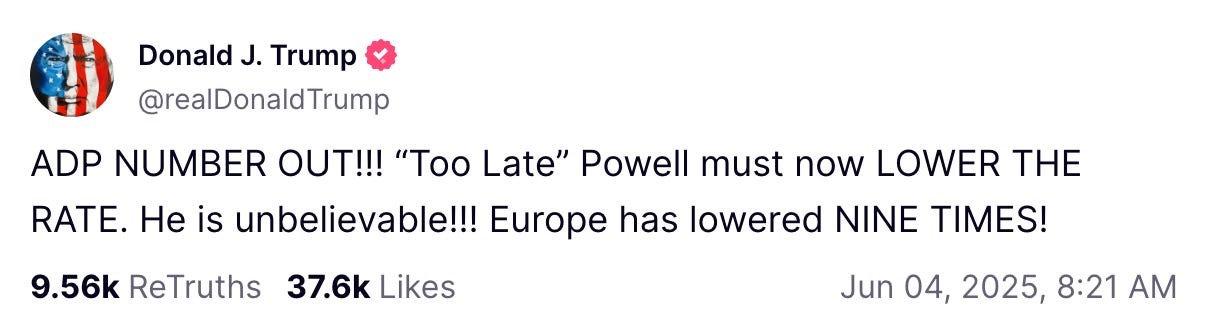

Trump has repeatedly stated that plan is to replace Fed Chair Jerome Powell explicitly because Chair Powell refused to lower rates.

While there is ambiguity as to whether Trump can fire Chair Powell3, there is no doubt that Trump will have his pick of chair when Powell’s term ends in May 2026. Whoever Trump chooses will proceed to lower the Fed’s target rate to appease him. But, lower or not, it may simply no longer be possible to hold Treasury yields down.

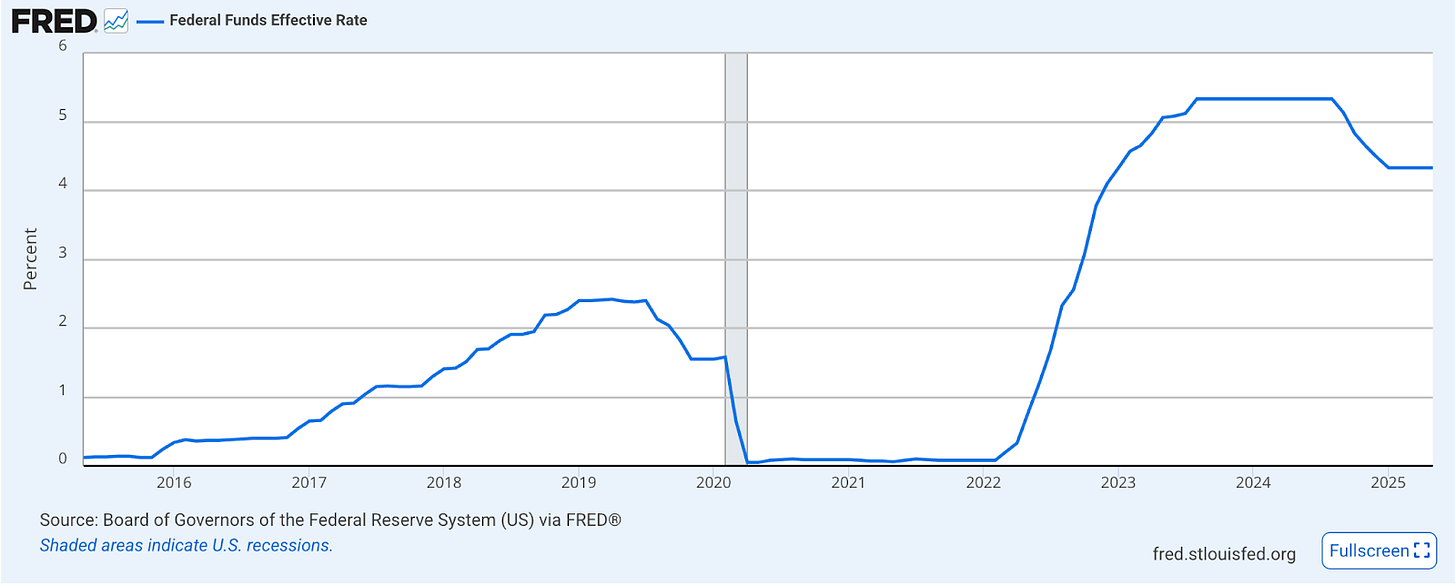

The Fed lowers rates by controlling multiple yield facilities that banking institutions access. To lower rates, the Fed lowers the rate of interest it pays through these various facilities. Mechanically, if you lower these rates, Treasury yields should also decline, since the cost of capital at large will decline and the arbitrage opportunity for investors will close the gaps between the two.

But much of the debt is in medium and long-term instruments; notes with maturities between two and ten year are currently ~41% of the U.S. debt and bonds of 20 and 30 years are ~14%. The yields for this debt are much more sensitive to investor perception of the long term risk than the market mechanics that Fed rate setting can directly influence. And that outlook for these instruments is now, inarguably, poor. Here is why.

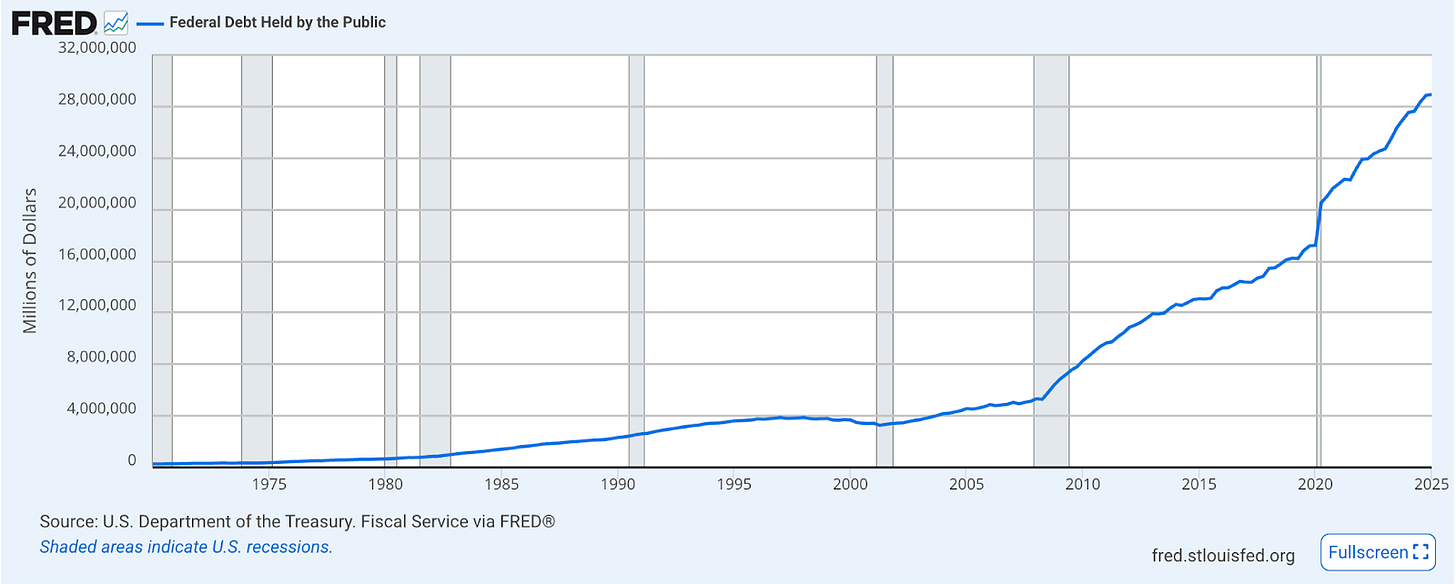

Currently, debt held by the public (economists preferred measure for understanding debt burden) is ~97% of GDP. Compare that to 35% prior to the 2008 Financial Crisis.

This figure rose steadily between 2008 and 2020, during a period known as “zero interest rate policy” (ZIRP), and then popped during the Covid-19 crisis. This is unfortunate, but at zero or near zero interest rates it was manageable, because while you have to make interest payments on the debt, those interest payments can stay really low when rates are low.

Then came the inflation crisis of 2021-2023, and the Fed was forced to raise interest rates from nil to around 5%, and keep them there.

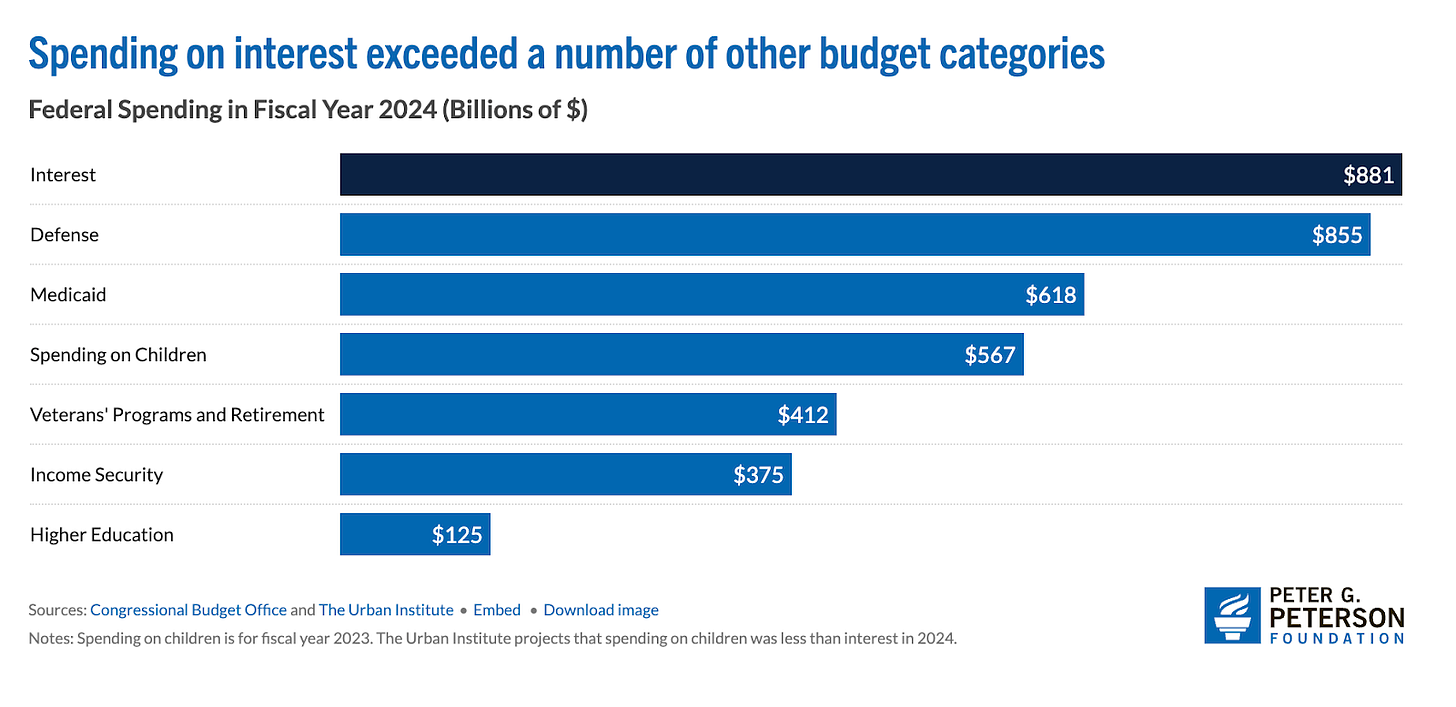

Increased interest rates slow economic activity and cool off the economy, tamping down inflation, but they also increase the cost of the U.S. debt. Some of our debt was old, issued during the ZIRP era, but over time that debt has to roll, and, like a lumbering beast, more and more of the U.S.’s massive debt burden is changing from cheap to expensive. This, in turn, caused the cost of servicing U.S. interest to grow massively, already dwarfing the cost of defense, a key indicator of poor fiscal health.

And here is the problem. Now that BBB has passed the House, and will likely become law, there are no more off-ramps. As interest costs grow, the government must either (i) cut other programs to make room in the budget, or (ii) increase the budget.

If the government cuts other programs, the economy will shrink, tax revenues will decline, the deficit will increase, and so the national debt will increase, which will cause interest costs to increase, and so compound the problem.

If the government increases the budget, to accommodate the interest payments, there will be no accompanying growth because interest payments do not stimulate economic activity, tax revenues will stay the same, the deficit will increase, which will increase the debt, and so interest payments will increase. And so on.

You see the point. It's a trap.

And this is what brings us back to the bad auction of May 21, just before BBB passed. Investors will not continue to purchase U.S. debt at low rates if this spiral continues, because it does not just weaken the United States, it materially changes the risk profile of the instruments themselves.

If the government doesn’t correct the debt spiral, eventually, interest payments will be the entire federal budget. But here is the thing, they actually won’t, because that will never happen. The United States is not going to tolerate paying high taxes for no services, what will actually happen is one of three other things:

(i) The U.S. will default on its debt, or write it down, as Trump has already suggested he might do;

(ii) The U.S. will print money to attempt to inflate its way out of the debt, or;

(iii) The U.S. will engage in financial repression and force institutions to carry Treasury debt at a loss.

In any of these scenarios holders of U.S. Treasury debt will be left holding the bag. Obviously, in a write down or default, their interest will be directly impaired, but if the U.S. ends up debasing its currency to overcome the debt, the end result in absolute terms is the same. The real value of the instrument has decreased.

Investors know this, and so as the legislative raft of U.S. fiscal policy tilts towards profligacy, they will demand higher yields for its debt.

And that makes it very good to be Circle.4

The Age of ZIRP is Over

David Foster Wallace’s famous graduation speech “This is Water” begins with a short parable.

There are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, "Morning, boys, how's the water?" And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, "What the hell is water?"

Low interest rates in the United States persisted for so long, that most of us forgot that they weren’t the norm. I was in high school during the 2008 Financial Crisis, and when I graduated college, the effective fed funds rate was .09%.

When I was in law school, while rates increased from .4% to 1.82%, Modern Monetary Theory rapidly gained popularity among an innumerate subset of the political left. The idea, roughly, was that you can always spend more. Tax revenue does not matter, because we can just print money.

Around the same time, the United States experienced a massive run-up in asset prices. Low rates meant that capital became much more profitable than labor, which led to capital accruing a disproportionate share of new money. This created “the everything bubble.” Competition for scarce high-value goods like real estate, equities, and watches drove up prices to astronomical highs. Price-earnings ratios in the S&P 500 climbed from 15x in 2009 to 36x today.

Even in our neck of the woods, one must admit that much of the growth of cryptocurrency was a direct result of speculative bidding on tokens, probably facilitated by low rates and easy money. And even though rates now are high, there is a sense in which most people still expect a return to normal.

Except, rates are never going back down. We’re never going back to ZIRP again. What will happen when the market recognizes this, I do not know. The arithmetic reality is that most professionals now have never worked in a prolonged high-rate environment. But that is what this is. And so we’ll soon find out.

Brogan Law is a registered law firm in New York. Its address and contact information can be found at https://broganlaw.xyz/

Brogan Law provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers.

Though perhaps there were other precipitating factors involved.

The Supreme Court’s recent Trump v. Wilcox ruling that touched on the matter in dicta is a must read. Who knew that “The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States?!”

Ok so technically, I should note that Circle mostly buys short-dated Treasury Bills that I told you are the most sensitive to Fed policy, but in the long term I think rate pressure will be sticky between long term debt and short term, not least because future Feds will be trying to control the inflation that this entire process will likely cause.